Wecome to Homstead Mortgage Group.

Based in Gilbert, Arizona, we are a full service mortage company that specializes in First Time Buyers, VA Loans, FHA in the Gilbert, Tempe, Mesa, Phoenix, Chandler, Scottsdale areas as well as the surrounding cities in Maricopa County. Whether you are buying a home or refinancing, we can help you realize your dream of home ownership or save you money with a new lower monthly payment.

We offer a wide range of refinance options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you with all of your needs.

We offer the following Refinancing Programs:

Homestead Mortgage Group offers the following niche programs as well: Reverse Mortgages, Custom Construction, Hard Money, Portfolio, Self-Employed Specialty Loans.

Contact us today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

Recent Articles

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

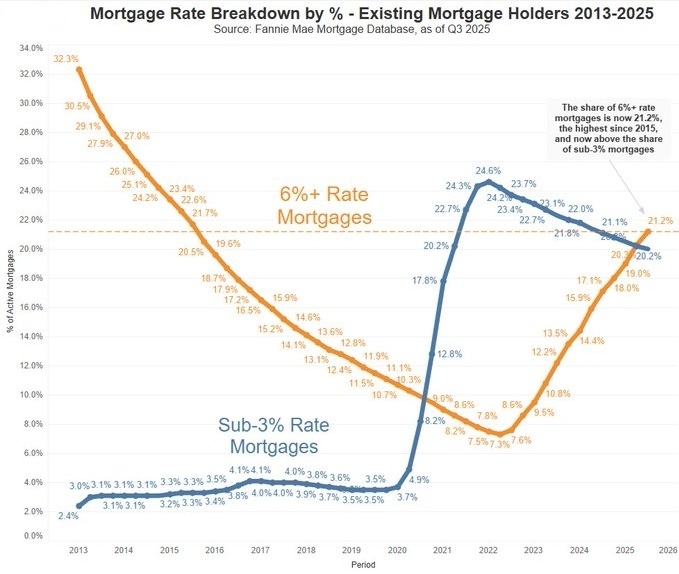

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...

30

2025

If the mortgage market felt unusually quiet over the holiday stretch, that’s because it was. The final weeks of December are known for “holiday trading,” which is when fewer people are actively buying and selling in the bond market. Since mortgage rates are driven by...